The Carbon Emissions of Global Shipping

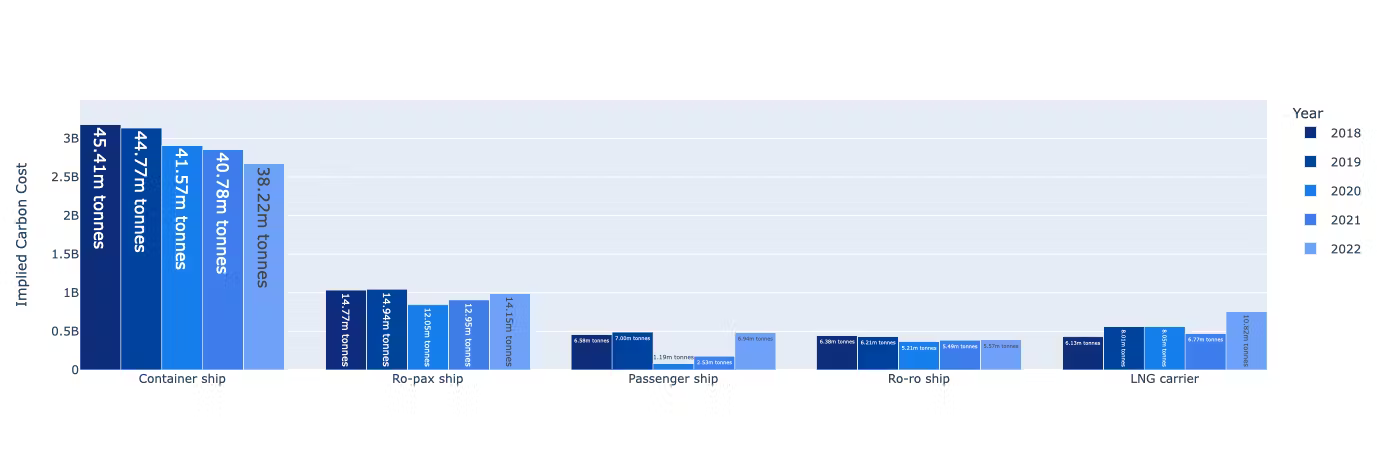

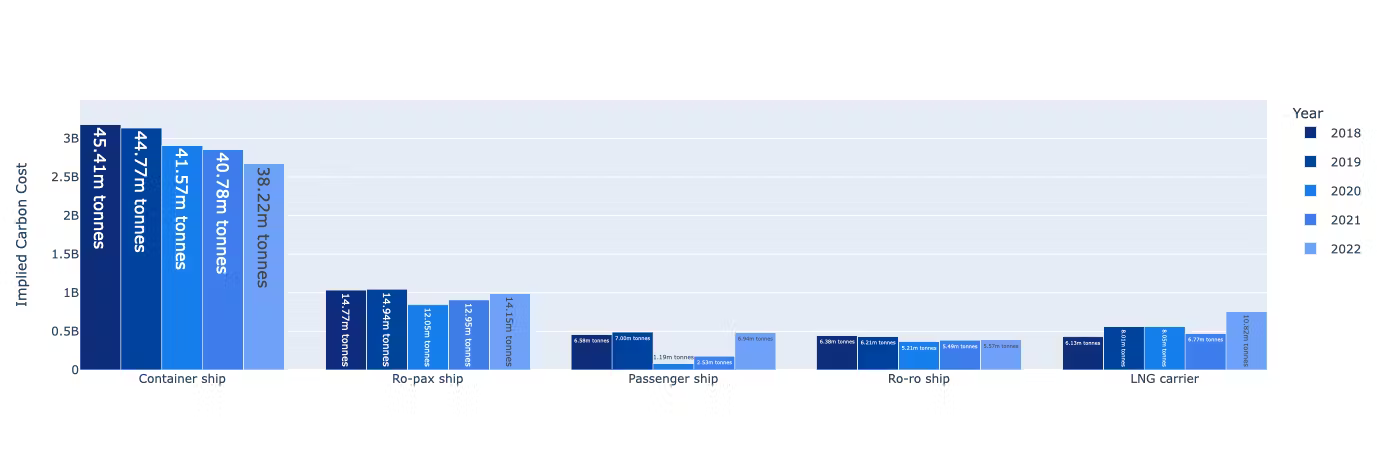

- Significant Economic Impact of Carbon Emissions: The TBL Shipping Dashboard in 2022 reported that carbon emissions in the shipping industry led to costs of £9.6 billion at a carbon price of £70 per kg of CO2. This underscores the financial and environmental implications of emissions, urging enhanced sustainability measures.

- Varied Impact Across Vessel Types: Among different vessel classes, Ro-pax vessels, used for ferrying vehicles and passengers, accounted for 7% of the sector's emissions and incurred about £1.0 billion in carbon costs. Conversely, General cargo ships were noted for their efficiency, indicating potential for lower carbon costs with better fuel performance.

- Global Shift Towards Emissions Trading: The shipping industry is increasingly integrating into global emissions trading schemes (ETS), particularly driven by EU regulations. This shift is expected to standardise carbon costs globally, encourage cleaner technologies, and ultimately align shipping with international climate goals.

In 2022, the TBL Shipping Dashboard highlighted the substantial financial implications of carbon emissions in the shipping industry. At a carbon price of £70 per kg of CO2, the total cost attributed to these emissions reached an astounding £9.6 billion. This figure reflects the industry's substantial contribution to global carbon emissions and underscores the economic stakes involved in environmental compliance and sustainability efforts.

Among the various types of vessels, Ro-pax vessels, which combine the transportation of both rolling cargo (vehicles) and passengers, were particularly notable. These vessels accounted for 7% of the total carbon emissions from the shipping sector, translating to a carbon cost of approximately £1.0 billion. This significant figure highlights the impact of ferry and similar services on both the environment and the costs incurred by shipping companies.

In terms of efficiency, the General cargo ships emerged as the most fuel-efficient class in the dashboard analysis. These vessels, designed for transporting packaged goods, maintained an annual average fuel consumption of 70 kg per nautical mile. This efficiency not only reflects better performance in terms of fuel usage but also suggests lower relative carbon emissions, which could lead to reduced carbon costs for operators.

Conversely, the most fuel-intensive vessels were the LNG carriers, which are specialised for transporting liquefied natural gas. These ships recorded an average fuel consumption of 268 kg per nautical mile, making them the most expensive class in terms of both fuel cost and associated carbon emissions. The high fuel consumption of LNG carriers indicates significant environmental and economic challenges, particularly in the context of stringent global emissions regulations.

This analysis from the TBL Shipping Dashboard provides a clear view of the diverse impacts of carbon pricing across different vessel classes within the shipping industry. It highlights the importance of investment in more efficient technologies and practices to mitigate financial risks and contribute to global sustainability efforts.

The Future of Emissions Trading and Carbon Pricing in Global Shipping

As the global shipping industry faces increasing pressure to reduce greenhouse gas (GHG) emissions, emissions trading schemes (ETS) and carbon pricing mechanisms are becoming pivotal tools in the drive for sustainability. The evolution of these systems, particularly within the context of European regulations, points to a transformative period ahead for maritime commerce.

Emissions Trading Systems in Global Shipping

The International Maritime Organization (IMO) is actively working towards integrating the shipping industry into broader ETS frameworks. A global ETS for shipping would require vessels to buy permits for their emissions, creating a financial incentive to reduce carbon output. This system not only encourages the adoption of cleaner technologies but also aligns the industry with global climate goals, such as the Paris Agreement targets.

The future of emissions trading in shipping looks towards a more unified global approach. Currently, regional systems, like the EU ETS, include intra-Europe shipping emissions, but extending this model globally could standardise carbon costs, eliminating competitive disparities caused by regional regulations. The challenge lies in gaining international consensus, which involves balancing economic impacts across diverse global stakeholders.

Carbon Pricing Trends in Europe

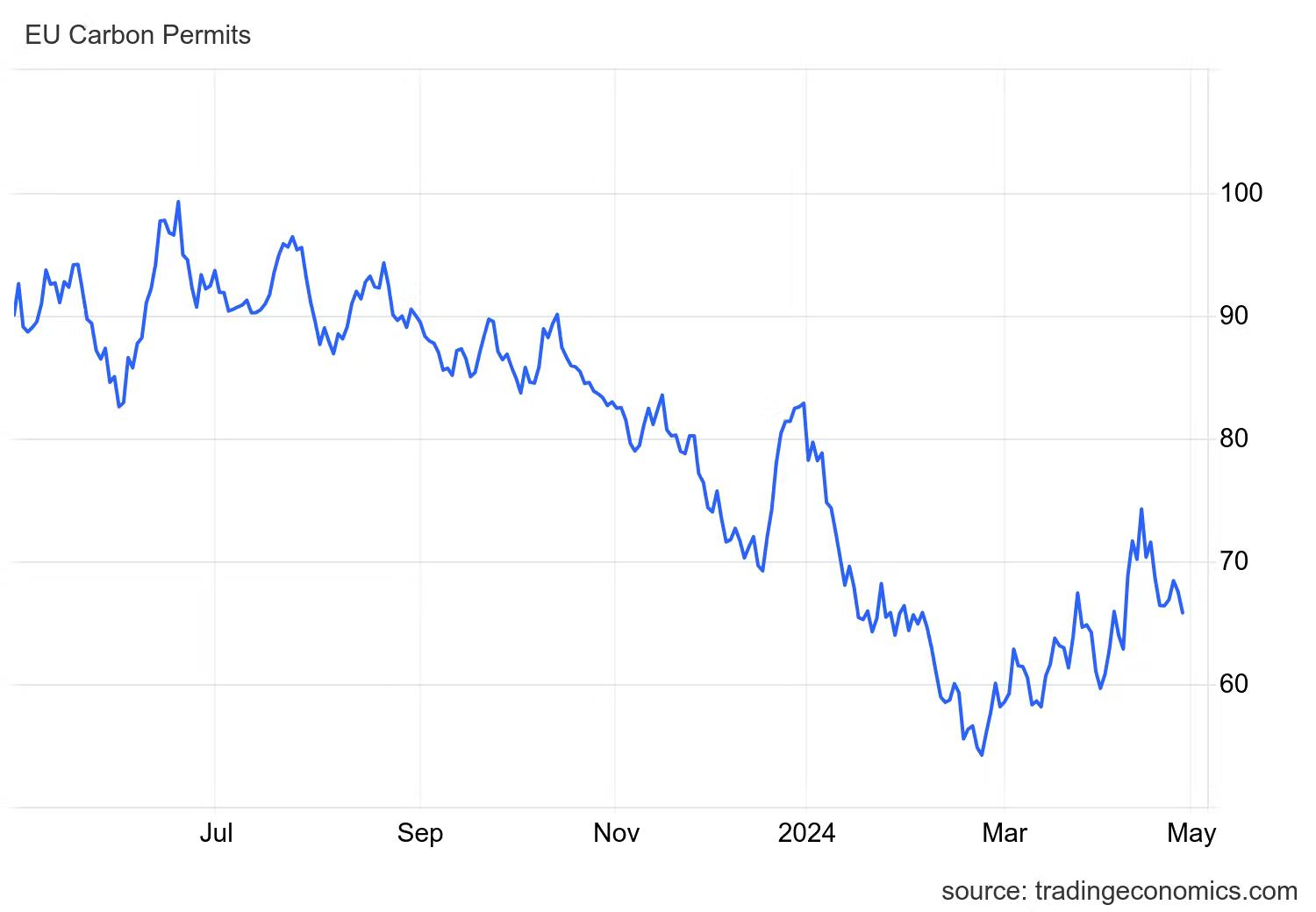

Europe has been at the forefront of implementing carbon pricing, with the EU ETS being the largest and most established carbon market in the world. The recent reforms and expansions of the EU ETS under the European Green Deal aim to increase its stringency. Shipping, which was previously exempt, is now being gradually integrated into this system. From 2023, a portion of emissions from large ships operating in European waters will need to be covered by emissions allowances, phasing to full inclusion by 2026.

The trend in Europe towards higher carbon prices reflects a robust strategy to drive significant reductions in carbon emissions. Carbon prices in the EU ETS have been rising steadily, reflecting tighter emission cap schedules and increased demand for allowances amidst broader economic and political support for climate action. This trend is expected to continue, further influencing operational costs and investment strategies in the shipping sector.

Impact and Implications for Global Shipping

The integration of global shipping into emissions trading schemes and the rising carbon prices in Europe are likely to have profound effects:

- Operational Costs: As carbon prices rise, the operational costs for less efficient vessels will increase, potentially making older and less efficient fleets economically unviable.

- Investment in Technology: There will be a stronger business case for investing in newer, more efficient technologies and alternative fuels, such as LNG, hydrogen, and ammonia-powered vessels.

- Market Dynamics: The inclusion in emissions trading schemes will also lead to new market dynamics where carbon pricing could affect shipping routes and speeds, with companies potentially opting for slower sailing speeds to reduce emissions and costs.

- Regulatory Compliance: Companies will need to navigate the complexities of compliance with both regional and potentially global ETS, requiring robust systems for monitoring, reporting, and verification of emissions.